If the only way our economy can be prevented from crashing is for the central govt bank to buy assets (a.k.a. invest), when the general population and businesses are unwilling or unable to, then you can be sure that is the greatest indicator of moral hazard in the modern financial world. In addition to lowering interest rates by using “monetary stimulus” tools, they are increasingly resorting to new, never before attempted methods.

The Fed is Increasingly Propping Up Financial Markets by Buying Private Equities/Debt

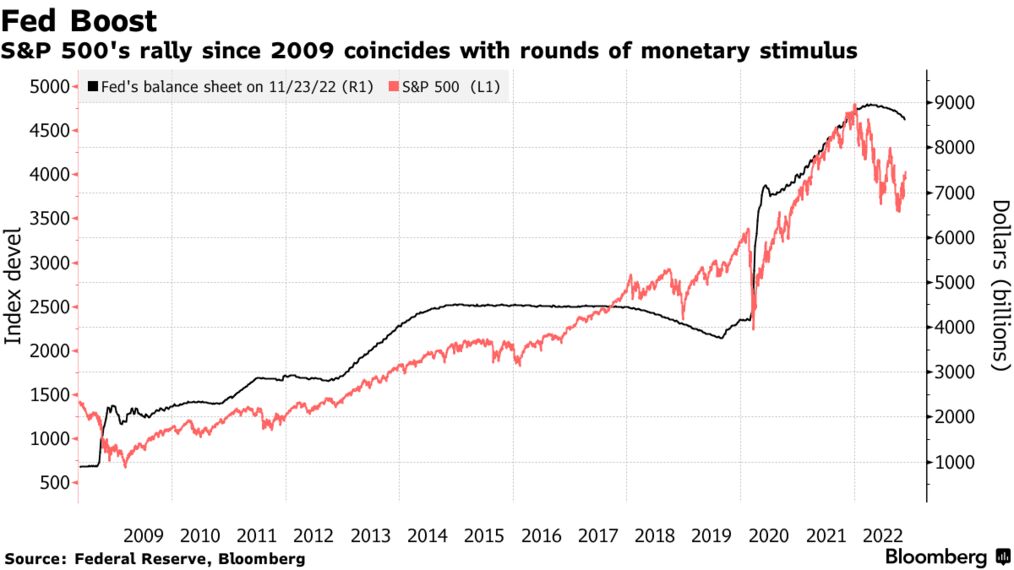

First off, realize that never before has the Fed started buying investments such as stocks and bonds, but they have run out of other “tools” to prop, or hold up, the market; perhaps you still recall the old days of “quantitative easing” which really just meant increasing the money supply and lowering interest rates so the world wouldn’t collapse.

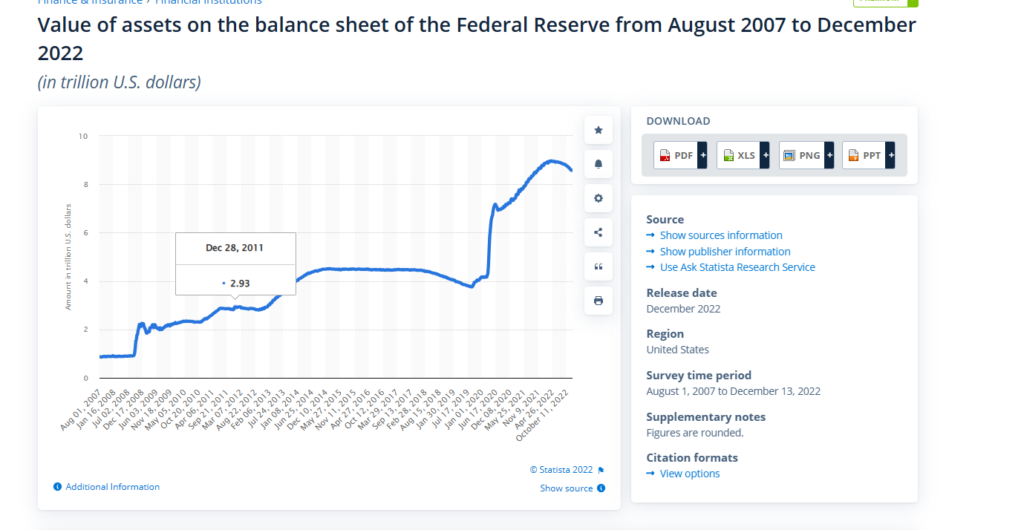

Here you can see their balance sheet, meaning what they own, is currently at 7 trillion dollars. When you consider the entire bond market is $53 trillion, and $47 trillion for the stock market, or $100 trillion in total, perhaps we should not worry that much that the Fed now owns 7% of it all, but it is clearly heading the wrong direction over time.

But let’s make this a lot clearer:

If it’s not obvious that the Fed’s “stimulus” programs are not the primary reason for propping up the economy, then there’s not much left I can do to prove my case. It seems rather likely at this point if they unload their balance sheet, the markets will unload too, possibly both the bonds and stocks, which is what we are. But if they return to printing money and buying investments, then we are probably heading for another bull market, so perhaps the Fed’s balance sheet is really the cue to watch each month. You can see the recovering from covid is almost perfectly correlated with the large boost in stock prices. There is always the chance though the population rejects this increasingly risky behavior, but it would surely be a crisis or a panic when it does.

The Fed is Not Just Any Debt Either: It’s Buying Bad Debt

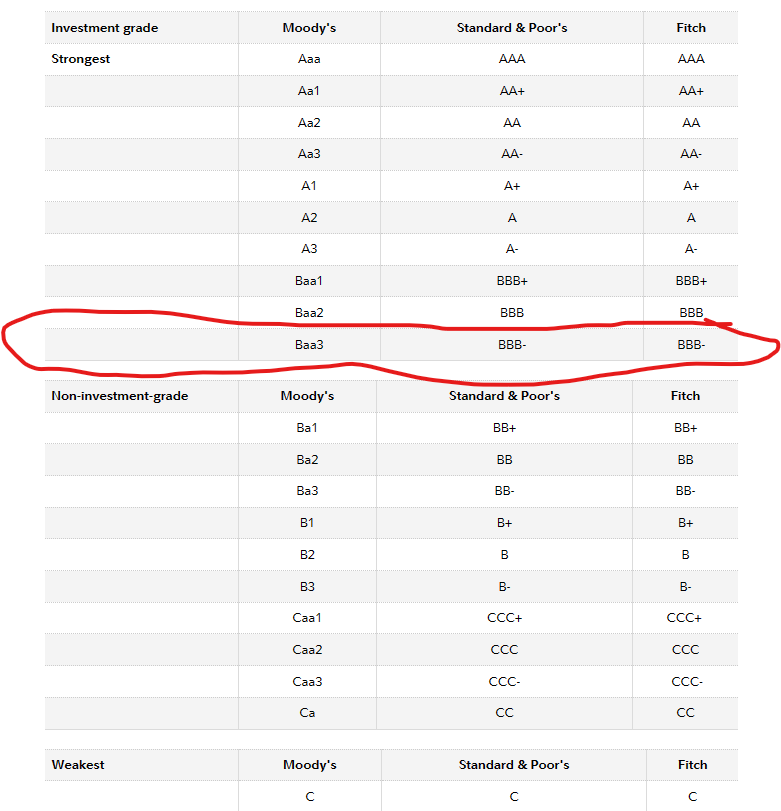

It should also be pointed out that that Fed, for the first time in history, started buying investments in companies as of 2018, including BBB- Grade debt, or “junk bonds.” If that does not sound risky for a govt to be purchasing, I do not know what does. Here is a chart showing a breakdown.

Okay, so maybe that’s comparable to a personal credit score of 600, but this is the United States banking system that we should trust. Note that as the Fed seems to continually get more involved in propping up the markets, we can conclude that the more emergencies there are over a given period, the more likely the system is slowly failing, and eventually, the terms will come due, but unfortunately, the longer the delay, the greater the build-up of potential energy. I have also stated repeatedly that while the govt caused the first Great Depression, shown by Milton Friedman, the govt is attempt to do the opposite to prevent a repeat, however, they are not very good at math because opposite actions prove nothing (track record for such attempts is also zero and yet the entire world plays the same game).

Fed Intervention, Dams and Waves

The current situation is like a dam that continually grows taller to stop flood waters, the largest occurs when it finally breaks. Ben Bernake claims to have saved the financial system, which is technically correct, but he also passed a buck to the next Fed chairman. The process continues today.

The writing is on the wall, but I do not know how long they can build a dam to hold back the waters, but as long as productivity slows over time, and behavior is increasingly heading the wrong direction, there is no cure, and the potential energy will just build, so when it does finally break, we will be talking about global war. Much of the aging world is in the same boat as the US, contributing to global group think and ultimately global existential risk, but no one listens much to me. It will lead to global war at some point. War will not disappear anytime soon, but it can be delayed as the globalizing nations increasingly moves in sync with each other.

Another analogy I use is that while the Fed can probably neutralize waves using opposite waves (short term bumps) using monetary policy, they cannot stop the tide (long term cycles) from coming or going. As the tide has gone out, they continue to try to stop the waves, but such is foolishness.